CORPORATE RETIREMENT PLANS

UNDERSTANDING THE NEEDS OF BUSINESS OWNERS AND PLAN PARTICIPANTS

PROVIDER SEARCH SERVICES

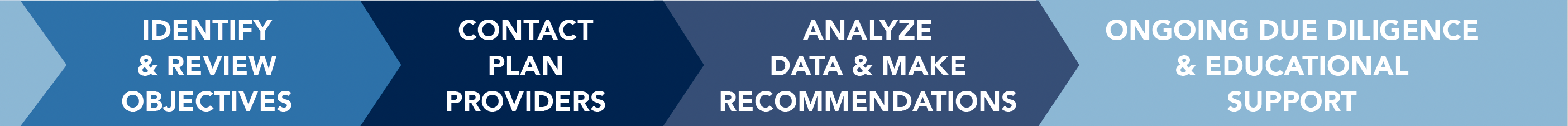

Turn to a trusted advisor to identify suitable plan providers, including record keepers and third-party administrators (TPAs). Our streamlined and proven process ensures a consistent and impartial evaluation of proposals from qualified providers.

EMPLOYER LEVEL SERVICES

We will assist you in fulfilling your fiduciary obligations of managing the plan administration, ascertaining the reasonableness of fees, and continuously monitoring plan investments.

PARTICIPANT LEVEL SERVICES

We offer a comprehensive range of participant-level services, including enrollment meetings, education, financial planning, and personalized investment advice, all customizable within your plan service agreement.

Managing a business retirement plan can be intricate and perplexing at times. Our retirement plan consulting process is designed to be both straightforward and efficient. Throughout the entire process, we will serve as your primary point of contact and relationship manager. With a comprehensive understanding of your retirement plan objectives, we are well-positioned to coordinate all aspects of the process effectively.

EMPLOYER LEVEL SERVICES

Review current Plan Providers

Review plan providers for cost, flexibility, and overall service quality every 3-5 years or as needed. Document findings, and if issues arise, we will start a vendor search with a clear evaluation process.

Review current Investment Policy Statement (IPS)

Review your Investment Policy Statement for compliance and alignment with your objectives. If none exists, we can help create one.

Review current plan investments.

Contribute to implementing a clear method for selecting and monitoring plan investments.

ERISA Consulting Services.

We work with clients to ensure their retirement plan goals are met and comply with the latest regulations.

YOUR FIDUCIARY DUTY

Although you are held to the standard of a knowledgeable investor, you may not possess the expertise required to prudently manage your plan’s investments. ERISA policy has also been interpreted to imply that qualified retirement plans should have established procedures for plan investment-related decision-making.

The Department of Labor has explicitly stated, “Unless they possess the necessary expertise to evaluate such factors, fiduciaries would need to obtain the advice of a qualified independent expert”. Goldstein Advisors is proud to offer both 3(21) and 3(38) Fiduciary Services.

OUR INVESTMENT CONSULTING PROCESS

Our five-step process outlines a clear path for our retirement plan clients to follow in order to meet their Fiduciary Responsibilities.

1. ANALYZE

Current Situation

2. DEVELOP

Investment Policies

3. CONFIRM

Investment Policies

4. IMPLEMENT

Investment Policies

5. MONITOR

Investment Policies

FEE ANALYSIS SUPPORT

Fee Reasonableness

Plan fiduciaries are obligated to ascertain the reasonableness of plan costs and have three fundamental responsibilities in determining fees:

- Exercise Control and Accountability: Plan fiduciaries must manage all investment-related fees and expenses incurred by the plan.

- Identify Compensation Recipients: Plan fiduciaries must identify all parties compensated from plan assets.

- Evaluate Fee and Expense Appropriateness: Plan fiduciaries must demonstrate that the fees and expenses paid are reasonable and appropriate based on the services provided.

Fee Oversight

As fiduciaries, you’re responsible for fee oversight in three areas:

- Negotiating the revenue sharing formula and methodology., if applicable

- Understanding the plan provider’s assumptions in determining reimbursement amounts. of any credits and forfeitures.

- Periodically monitoring plan provider actions to ensure accurate calculations and applications of plan assets.